Peppol : understanding, anticipating, and leveraging Electronic Invoicing

💡 Discover how Peppol works, why it's mandatory, and how to implement it.

Want to talk to one of our experts about Peppol?

Get your whitepaper here

Why Peppol is more than just an obligation?

Electronic invoicing is becoming an unavoidable obligation in Europe. With Peppol, it’s not just a regulatory constraint but a strategic opportunity to optimize financial management for businesses.

Anticipating this transition will help you stay competitive while complying with the new requirements.

Understanding Peppol and its challenges

- What exactly is Peppol?

- Why is electronic invoicing becoming mandatory?

- What are the risks of non-compliance?

Understanding Peppol and its Challenges

What exactly is Peppol?

Peppol (Pan-European Public Procurement Online) is a secure network that facilitates the standardized exchange of electronic invoices between businesses and public administrations across Europe. Designed to ensure full interoperability between different management systems, Peppol is based on:

✔ A standardized format using the UBL (Universal Business Language).

✔ A secure network to reduce fraud and ensure data integrity.

✔ Growing adoption, with regulations making it progressively mandatory.

Belgium, like many European countries, is gradually enforcing the use of Peppol for electronic invoicing in businesses.Electronic invoicing is becoming an unavoidable obligation in Europe. With Peppol, it’s not just a regulatory constraint but a strategic opportunity to optimize financial management for businesses. Anticipating this transition will help you stay competitive while complying with the new requirements.

Why is electronic invoicing becoming mandatory?

Starting on January 1, 2026, electronic invoicing will gradually become mandatory for all Belgian businesses. The goal? To digitalize the economy, reduce accounting errors, and combat tax fraud.

With this transition, paper invoices and traditional PDF files will become obsolete. Adopting Peppol now allows businesses to anticipate this change and avoid administrative bottlenecks.

Key dates to remember:

- 📅 January 1, 2026: Mandatory for all B2B transactions between VAT-registered companies in Belgium.

- 📅 March 1, 2026: Mandatory for B2G transactions for contracts published after this date.

What are the risks of non-compliance?

Delaying the adoption of electronic invoicing can lead to several negative consequences.

Don’t undergo this transformation passively—anticipate it and turn it into a strategic advantage!

➡ Download our complete whitepaper to discover the steps for a successful transition.

RISKS :

- Financial penalties: Companies that fail to comply may face fines or other sanctions.

- Payment delays: Both public and private clients will require invoices that meet Peppol standards.

- Loss of competitiveness: Outdated invoicing processes can harm your business’s responsiveness and reputation.

How to successfully transition?

What concrete steps should you take to prepare?

Switching to Peppol isn’t just about installing software. A structured approach ensures a smooth transition:

✅ Assess your current situation: Conduct an audit of your accounting and invoicing tools.

✅ Choose a compatible solution: Opt for an ERP like Odoo, which natively integrates Peppol.

✅ Implement internal training: Ensure your teams understand the new requirements.

✅ Anticipate the transition: Don’t wait until the deadline to avoid a last-minute rush.

Expert guidance from a company like Eezee can simplify each step and ensure compliance without stress.

Peppol and Odoo: How do they work together?

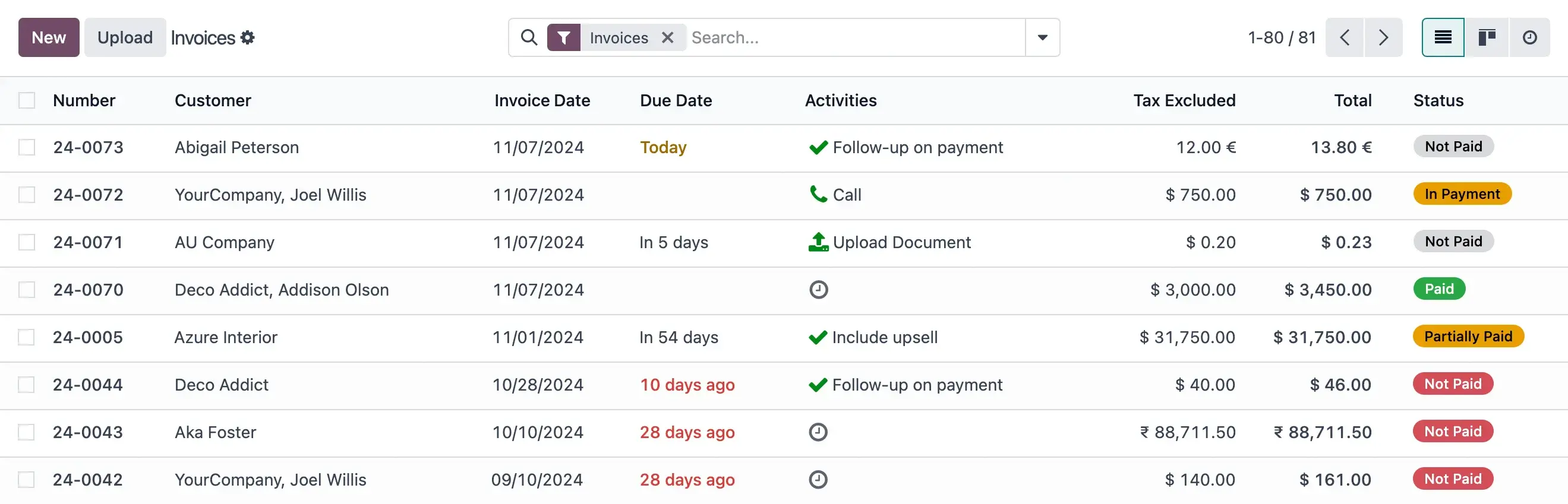

If your company already uses Odoo, great news! This ERP offers native Peppol integration, making the process easier:

✔ Automatic generation of invoices in UBL format.

✔ Direct invoice submission via a certified Peppol access point.

✔ Secure document archiving to ensure regulatory compliance.

Odoo streamlines the transition and automates electronic invoice management.

💡 Want to learn more about this integration? Check out our whitepaper’s practical guide.

How much does implementation cost, and how long does it take?

The cost of transitioning to Peppol depends on several factors:

- Odoo license fees: Vary based on the number of users and activated modules.

- Integration costs: Depend on the complexity of your current processes.

- Employee training: Essential for successful adoption.

⏳ Estimated implementation time:

- If you already use Odoo: Quick activation in a few days.

- If starting from scratch: Full implementation takes 4 to 8 weeks.

Peppol compliance for any Odoo version

Peppol e-invoicing is fully standard from Odoo V16 to V19, but many companies are still running older versions.

Eezee has developed a module to cover V13, V14, and V15, so every business can stay compliant without rushing an upgrade.

Key points:

- Works out-of-the-box on V16 → V19

- Supports older versions: V13, V14, V15

- Keep your current Odoo setup while adopting Peppol

get a customized cost and timeline estimate for your Peppol transition. Book a call

Maximizing the benefits for your business

Why is Peppol an opportunity and not just a constraint?

Adopting Peppol is more than just a regulatory requirement—it’s an opportunity to improve operations and modernize your business.

Businesses that anticipate this transition will gain a major competitive advantage. Instead of merely complying with regulations, they can optimize financial processes and improve client relationships.

Key benefits :

- Time savings: No more manual invoice entry—everything is automated.

- Reduced errors: Standardized invoice format minimizes disputes and corrections.

- Faster payments: Secure, instant invoicing leads to quicker payments.

- Enhanced security: Transactions are protected against fraud and human errors.

- Better cash flow management: Real-time tracking of invoices and payments.

Why choose Eezee for support?

Transitioning to Peppol isn’t something you improvise. To avoid mistakes and ensure a smooth adoption, expert support in Odoo and Peppol integration is crucial.

Eezee is more than an integrator. It’s an Odoo Gold Partner since 2010. We’ve already helped over 250 businesses in their digital transformation with Odoo. We specialize in electronic invoicing and Peppol integration.

Why work with us?

- End-to-end support: Audit, configuration, training, and assistance.

- Tailored integration: Odoo is customized to your business needs.

- Transparent budgeting: No hidden fees—we define a clear fixed price upfront.

- Responsive support: Our team of experts is available for any questions.

- Proven expertise: As an Odoo Gold Partner, we have full mastery of electronic invoicing.

Peppol: a strategic lever for your business

Peppol is not a burden, it’s an opportunity for SMEs to simplify operations and boost efficiency.

Anticipating regulations helps avoid penalties and optimize internal processes.

Choosing Odoo and Eezee means leveraging a powerful ERP with expert guidance.

Automating processes lets you focus on growth and innovation.

Don’t let the Peppol transition catch you off guard! Download our detailed whitepaper and turn this obligation into a competitive advantage.

Looking to transition to electronic invoicing with complete peace of mind?

Our whitepaper provides all the key insights to understand Peppol, anticipate the transition, and maximize benefits for your business.

In this guide, you will discover:

- Legal requirements and official timeline: Avoid penalties and prepare on time.

- Practical steps for a smooth transition: From assessing your current setup to implementing Peppol with Odoo.

- Common challenges and how to overcome them: Costs, internal organization, and process adaptation.

- Strategic benefits of Peppol: Automation, cost reduction, and improved cash flow.

- Why Odoo and Eezee are the ideal solution: Fast, stress-free, and tailored integration.